What Is Financial Accounting? Financial Accounting In A Nutshell |

您所在的位置:网站首页 › what is assets in accounting › What Is Financial Accounting? Financial Accounting In A Nutshell |

What Is Financial Accounting? Financial Accounting In A Nutshell

|

Financial accounting is a subdiscipline within accounting that helps organizations provide reporting related to three critical areas of a business: its assets and liabilities (balance sheet), its revenues and expenses (income statement), and its cash flows (cash flow statement). Together those areas can be used for internal and external purposes. Contents Financial Accounting Origin Story Who was the father of the Double-Entry System?Double-Entry System in a NutshellFinancial Statements in a NutshellWhat is an asset?What is a liability?What is equity?The accounting equationWhat is a balance sheet?What Are Revenues and Costs?What is the purpose of the income statement?What is the purpose of the accounting discipline?Time to Master the Accounting GameFinancial Accounting Case StudyBroken Inc. Is Temporary UnbrokenFixing the Finances of Broken Inc. How to Balance a Balance Sheet: Balancing Things OutSumming up and ConclusionsConnected Business ConceptsAccounting EquationBalance SheetIncome StatementCash Flow StatementCapital StructureCapital ExpenditureFinancial StatementsRelated Financial Accounting Origin StoryWhen humans lived in the savannah, they lived in small groups, which would consist approximately of no more than a few dozens individuals. Through the millennia the human tribes evolved in groups that became larger and larger until they became societies. Societies are characterized by large groups of people that interact on a daily basis. Those people are in some way associated with religion, culture, and commerce. While religion and culture evolved mainly by word of mouth, commerce instead needed to develop other (more complicated) tools to thrive. In fact, if a little society is comprised of a few hundred merchants; and if we consider all the possible interactions that could happen between them, they would easily amount to millions of transactions. Therefore, the sole word of mouth wasn’t sufficient for keeping track of all those transactions. That is where “writing” came handy. The ancient Mesopotamian merchants, thus, started to develop tools that would allow them to track all the goods exchanged. This evolution continued up to Middle Ages Florence. At that time, Florence was a metropolis (we can compare it to modern New York), and commerce had boomed. In fact, merchants from all over the world flowed into Florence to buy and sell any goods. The commercial routes between Florence and Venice were quite trafficked. Not surprisingly Florentine merchants had to come up with a tracking system that would allow them to consistently keep up with the millions of transactions taking place in Florence. Most probably the Florentine merchants initially came up with several systems for tracking those transactions. Thus there was no standard or consistency. Somehow by the fifteenth century, a tracking system called “double-entry” (developed in Venice) took over and became the most used accounting system at that time. Who was the father of the Double-Entry System?Luca Pacioli (a mathematician and Franciscan Friar from Tuscany) formalized the double entry in his Summa de arithmetica, in 1494. In his work Luca Pacioli tells us that any business to be successful necessitates of three things: Capital (cash or credit) A good accountant A good internal system.For “capital,” Pacioli, intended mainly cash (he understood way before than Franklin that “cash was the king”), but also credit. In other words, Pacioli believed that trust was the pillar of any business. He used the word credit because it comes from the Latin word “credo,” which means, “trust.” The second and third aspects are crucial as well. In fact, a good accountant has to have a basic understanding of mathematics (very basic). And he has to be able to effectively use an internal system, which he calls a double-entry system. That system became the official system of the western world. And it is still in use today. How does it work? Double-Entry System in a Nutshell Double-entry accounting is the foundation of modern financial accounting. It’s based on the accounting equation, where assets equal liabilities plus equity. That is the fundamental unit to build financial statements (balance sheet, income statement, and cash flow statement). The basic concept of double-entry is that a single transaction, to be recorded, will hit two accounts. Double-entry accounting is the foundation of modern financial accounting. It’s based on the accounting equation, where assets equal liabilities plus equity. That is the fundamental unit to build financial statements (balance sheet, income statement, and cash flow statement). The basic concept of double-entry is that a single transaction, to be recorded, will hit two accounts.

The double entry is merely a tracking system. Each transaction is classified according to two entries (hence it is called double-entry): debit and credit. In short, like computer language is expressed in bits, which consist of a bunch of 0s and 1s, accounting language is expressed in debits and credits. What do those terms mean? Debit comes from the Latin “debitum,” which simply means, “What is owed.” Credit instead comes from the Latin “creditum” that can be translated as “having been loaned.” But what is owed or loaned? The only good exchanged in the accounting world is money. Therefore, when we say debit and credit, it always refers to assigning a $ amount to the goods or services sold or bought by the organization. Therefore each time a transaction needs to be recorded in the accounting journal (so-called General Ledger) the money needs to be debited to an account while credited by another account. In this way the transaction balances. Before you can record your first transactions, you must have a basic understanding of the primary financial statements: balance sheet and income statement. Financial Statements in a NutshellThe central premise of accounting is to keep track of a bunch of transactions taking place in a particular period. For some reason, the double-entry system prevailed. This system says that each time you record a transaction, you must debit one account and credit another account. But what is an account? An account is merely a way of classifying different transactions. In fact, in bookkeeping exist five main accounts: Asset Liability Equity Revenue Cost What is an asset?In short, the assets are all those resources that the company has at its disposal to run the business in the short and long term. What is a liability?The liabilities instead are mainly the money borrowed to acquire those resources. What is equity?Not all the resources (assets) are acquired through debt (liability). In fact, you may invest some of your money into the business to buy the machinery or other stuff that will help you to run it. In this case, the money you put into the business is called equity. That’s it. The accounting equation The accounting equation is the fundamental equation that keeps together a balance sheet. Indeed, it states that assets always equal liability plus equity. The foundation of accounting is the double-entry system which assumes that a company balance sheet can be broken down in assets, and how they get sources (either though equity/capital or liability/debt). The accounting equation is the fundamental equation that keeps together a balance sheet. Indeed, it states that assets always equal liability plus equity. The foundation of accounting is the double-entry system which assumes that a company balance sheet can be broken down in assets, and how they get sources (either though equity/capital or liability/debt).

For instance, if you open an ice-cream shop, you will buy the machine (asset) by borrowing some money from the bank (liability) and by putting some of your money (equity). Consequently, the value of your machinery (asset) will be equal to the borrowed money (liability) plus your own money (equity). From here the so-called accounting equation A = L + E. What is a balance sheet?Those three accounts (Assets, Liability, and Equity) comprise the so-called Balance Sheet. Thus, for any given instant of the life of your business, the balance sheet will tell you what the $ amount of assets the company owns is and how those assets have been acquired (Either through debt, also called liability or through equity, also called capital). Consequently, the $ amount of liability and equity must balance with the $ amount of assets the company owns. Pretty straightforward! Isn’t it? If you didn’t get it yet, don’t worry we are going to see some beneficial practical examples. Knowing how much assets, liabilities, and equity the company owns or owes at each instant, (in accounting lingo) is called “financial position.” What Is a Financial Option? The Complete Beginner’s Guide to Financial Options What Are Revenues and Costs?On the other hand, we are still missing two accounts: revenue and cost. The revenues are merely the money flowing into the business at any given period. The costs are all the expenses flowing out at any given period. The costs can be broken down in several ways. By subtracting the costs to the revenues of the business you get what is called Net Profit/Loss; which in accounting jargon is also called “bottom line.” Those two accounts together form the so-called “Income Statement.” Accountants use a lot of other names for it (Profit and Loss or Statement of comprehensive income), which all mean the same thing. What is the purpose of the income statement? The income statement, together with the balance sheet and the cash flow statement is among the key financial statements to understand how companies perform at a fundamental level. The income statement shows the revenues and costs for a period and whether the company runs at profit or loss (also called a P&L statement). The income statement, together with the balance sheet and the cash flow statement is among the key financial statements to understand how companies perform at a fundamental level. The income statement shows the revenues and costs for a period and whether the company runs at profit or loss (also called a P&L statement).

Therefore, the primary purpose of the income statement is to show how much money went in and out, and if the balance was positive or negative. Keep in mind that “money” does not mean “cash.” in fact, often accounting runs on an “accrual basis.” It simply means that transactions are recorded in the income statement independently from cash disbursement. A cash basis, instead, indicates that transactions are recorded only when cash is passed from hand to hand. To have a detailed understanding of the income statement, you can watch this short video: If you followed along so far, you should be able to get to the final step: recording transactions What is the purpose of the accounting discipline?We saw that the accounting equation’s primary purpose is to keep things in balance. It makes perfect sense. In fact, in the real world, if you put $5 in your pocket, you will still find $5 (unless you are a magician, which in the accounting world is called “fraudster”). Things get a little bit trickier in accounting. Keep in mind that the double-entry system has been designed to understand where the money came from. Imagine the case in which you have a $100 bill. You put it in your pocket. After a few weeks you take it out, but you completely forgot where it came from. Did I borrow it from someone? Was it the money I saved? Did anyone pay me for the work done? You don’t have an idea! While you can afford to let this happen in the real world, this must never happen in the business world. Companies often buy and sell hundreds of goods or services. This generates a huge volume of transactions. Thus, knowing where anything comes from it is crucial for three main reasons: Internal control Tax compliance Performance measurementFirst, as you can imagine companies without an efficient system that keeps track of all their transactions would not be able to know what happens within the organization. This can lead to fraud, bad management, and so on. Second, the government also requires companies to submit their tax returns. To do so, businesses must keep track of all their transactions and know how to classify them. Third, another branch of financial accounting (ratio analysis) is also crucial to understand how the business is managed from several perspectives. Time to Master the Accounting GameSo far we saw that the accounting world uses two main documents (balance sheet and income statement) to answer two central questions: First, how much of my assets have been acquired through debt and capital? Second, are my assets generating a net profit or a net loss?By answering the first question, we can determine the financial position of the organization. By answering the second question, we can understand if the assets we bought are generating profits. Hence, we can determine if it is worth going on with the venture. A third document is crucial to understand business performance as well (the cash flow statement). Yet, if you master balance sheet and income statement you are on the right path to developing more profound business acumen. The two questions above are crucial to understanding how to record transactions in the accounting books. Hence, we will do this exercise by thinking about situations that may present in your life. This time though each time you put a $100 bill in your pocket you have to answer the two questions above. Let’s start then, action! Financial Accounting Case Study Financial statements help companies assess several aspects of the business, from profitability (income statement) to how assets are sourced (balance sheet), and cash inflows and outflows (cash flow statement). Financial statements are also mandatory for companies for tax purposes. They are also used by managers to assess the performance of the business. Financial statements help companies assess several aspects of the business, from profitability (income statement) to how assets are sourced (balance sheet), and cash inflows and outflows (cash flow statement). Financial statements are also mandatory for companies for tax purposes. They are also used by managers to assess the performance of the business.

You are broke, 0$ in your pocket! But you have to pay the rent! It amounts to $500. The landlord is coming tomorrow. How do you fix this situation? Although you are a grown-up, it is an emergency situation. Thus, you put your pride aside and ask your parents. They love you of course. Therefore, they give you money. We are going to assume that your right pants’ pocket is a venture. We will call it “Broken Inc.” Broken Inc. has now one shareholder (yourself) and a bank (your parents). How do we record this transaction in the accounting world? Easy. Do we have to answer the first question: how did we acquire that money? Since your parents gave them to you, we will assume that you are proud enough to give them back, once you earn them. Thus, we will consider $500 as a loan. According to the accounting equation, Assets are on the left side, while Liability and Equity on the right side:

To record transactions, accountants use a visual aid called T-Entry (nowadays it’s all done automatically by software. This may seem a good thing, but often it’s not. When folks don’t take the time to understand how accounting works from its foundation screw-ups are guaranteed in the long run):

As you can see on the left side we have debit and on the right side credit. This means that each time we want to show that our assets increased we just debit them (remember assets are on the left side of the accounting equation) and vice versa. Instead, each time we want to show that our liability or equity increased we just credit them (remember that liability and equity are on the right side of the accounting equation) and vice versa. To recap: To show an increase in assets we debit them. To display a decrease in assets we credit them:

We can now put things together:

Let’s record the transaction. Broken Inc. received $500. It is a loan. This means that now in Broken Inc. bank account (your pocket) there is $500. But it is a loan. In fact, they will be given back to the bank (your parents). We will record the transaction in the following way:

Therefore, your pocket (which is your cash account) will be debited. Why? It is a short-term asset. On the other hand, we will credit the $500 to an account which I arbitrary called “Parents’ Loan.” Why? It is a liability. In other words, we showed that your cash account increased by $500. But we also know why that happened. Your parents gave you the money. Hence, once you will go back in a few weeks’ time and look at Broken Inc. balance sheet, you will know where the $500 came from. As you can see from the image above, the T-Entry is immediately translated into your balance sheet. In fact below the t-entry, the balance sheet (BS) shows that you have $500 in assets but also $500 in liability. Thus even though, in the present, you have $500. You know that in the future you must return them back. Remember those are virtual transactions. It means that they take place only in your accounting books. In reality, you have $500, and that’s it! But accounting is a little bit trickier than reality because it needs to answer the two questions we saw at the beginning of the paragraph. What Is a Financial Ratio? The Complete Beginner’s Guide to Financial Ratios Broken Inc. Is Temporary UnbrokenIn Scene One your parents saved your rear. The landlord is knocking at your door. He will ask for the rent. The only liquid money available will disappear in a few minutes. For now, though you don’t worry too much. You open the door, and the landlord is already with his hand forward waiting for the $500. This means that you will put the hand in your right pants’ pocket. We will consider the rent’s money as an expense that Broken Inc. is incurring. In fact, expenses are often connected with the assets. For such reason on our income statement, we will place them on the left side. On the other hand, we will place the income on the right side. In other words, our income statement will look like the following:

This implies two things: To show an increase in expenses, we will debit them (they are on the left side of the t-entry) and vice versa. To show an increase in revenues, we will credit them (they are on the right side of the t-entry).Thus it will look like the following:

You have the insight to record the transaction now. Since you paid the rent to the landlord, this is a “rent expense.” yet to pay it by withdrawing the money from Broken Inc.’s pocket account. Therefore:

As you can see in the upper part, we recorded the transaction. We showed an increase in rent expense by debiting it and a decrease in Broken Inc. Pocket (asset) by crediting it. On the below part you can see how your financial statements look like (balance-sheet + income statement are called so). Thus, the Income Statement (IS) shows a net loss of $500, while the balance sheet (BS) shows only $500 in liability. There is something wrong here. Do you notice anything? Not yet? Let me give you an insight. It is not by chance that the “balance” sheet it is called so. In fact, it has always must balance. Always! Therefore, when you see the asset side showing a different amount compared to the liability + equity side, something is wrong. In this case, nothing is wrong. We just missed a step. In fact, to match the asset side with the liability & equity side of the balance sheet, we have to connect it to the income statement. How? We must report the losses in the equity section of the balance sheet. In fact, in accounting when you have a net loss on the income statement, it will also be shown as “accumulated loss” on the balance sheet. Once we do so the BS will balance out:

As you can see the liability and equity cancel each other out. Therefore, eventually, your balance sheet will have $0 in total assets and $0 in liability plus equity (the parent’s loan cancels out with the accumulated losses, which makes the equity account negative). Broken Ink. is in financial distress again. It is time for you to fix its finances since you are its greatest asset. It is time to earn some money! Fixing the Finances of Broken Inc.You decide to pay back to money your parents gave you to pay the rent. Therefore, you look for a job and finally find it. You will be working as a waiter in a restaurant, earning a fixed salary of $1,000 per month. Mr. Sal agrees to pay you in advance (he is very kind). Thus, you finally get the paycheck. The paycheck is going to be income for Broken Inc. Finally, you will not show a net loss. Thus, you record the transaction on Broken Inc. accounting books:

As you can see in the upper part, we recorded the t-entry. In short, we debited Broken Inc.’s pocket to show that the cash account increased by $1,000. Also, we credited the salary account to show that it increased by $1,000. As you can see below the t-entry, the entry on the left (Broken Inc. pocket account) is translated on the balance sheet. The entry on the right (salary) is translated into the income statement. Since the salary offset the rent expense, you now have a net profit of $500. That net profit was also translated on the balance sheet as accumulated earnings. Neat! Finally, Broken Inc. paid all its debts, and it has a $500 surplus. Don’t you think it is time to pay back your parents’ loan? How to Balance a Balance Sheet: Balancing Things OutYou proudly walk toward your parents’ house. In a week things have changed. You grew up and learned the lesson. It is time to repay your parents. You get into the house. Your mother is in the kitchen. She is cooking for you. You sit at the dinner table and announce to your parents that you found a job. Therefore, you give them back the $500 they borrowed you. Broken Ink is 100% yours now! You are your own master. Let’s see how to record the last transaction:

As you can see we debited the Parents’ Loan (liability) to show its decrease. On the other side, we credited the Broken Inc. Pocket account (asset) to show its decrease. This transaction only affected the balance sheet. In fact, the left side of the t-entry zeroed out the loan. The right side of the t-entry resulted in a $500 decrease in the same account. The income statement was unaffected. In short, Broken Inc. has $500 in cash, which are all yours, since those are accumulated earnings. Congratulations! Summing up and ConclusionsThroughout this short manual, we saw that accounting was already used in ancient Mesopotamia. The double entry system though was developed in Venice but formalized for the first time by a Tuscan mathematician, Luca Pacioli. In his work, Summa de Arithmetica, Pacioli delineated the three most important aspects of any business: Capital (cash or credit). A good accountant. A good internal system.Also, we saw that the two main documents that describe the situation of any business are the balance sheet and income statements. Together they form the so-called financial statements. Those two documents classify the accounting transactions under three main accounts: Asset. Liability. Equity. Revenue. Cost.Assets, Liability, and Equity are shown under the balance sheet, for which the primary purpose is to show the financial position of the organization. The “balance” sheet is called so because the Asset side always has to match up with the Liability and Equity side. From this premise we get the accounting equation A = L + E. after that, we have the income statement, which classifies the transactions in Income (or revenue) and Cost (or expense). Its main purpose is to show whether the business has a net profit (total revenue is higher than total costs) or a net loss (total expenses higher than total revenues). Together those two statements answer two central questions: First, how much of my assets have been acquired through debt and capital? Second, are my assets generating a net profit or a net loss? The profit margin is a profitability financial ratio, given by the net income divided by the net sales, and multiplied by a hundred. That is expressed as a percentage. That is a key profitability measure as combined with other financial metrics, it helps assess the overall viability of a business model. The profit margin is a profitability financial ratio, given by the net income divided by the net sales, and multiplied by a hundred. That is expressed as a percentage. That is a key profitability measure as combined with other financial metrics, it helps assess the overall viability of a business model.

The gross margin is a financial ratio, which helps assess the profitability of a business and also its operational efficiency. Indeed, as gross margins take into account the cost of goods sold (the cost incurred to deliver the software to the customer) it’s a measure to assess the value of a business.

Connected Business Concepts

Accounting Equation The gross margin is a financial ratio, which helps assess the profitability of a business and also its operational efficiency. Indeed, as gross margins take into account the cost of goods sold (the cost incurred to deliver the software to the customer) it’s a measure to assess the value of a business.

Connected Business Concepts

Accounting Equation

The accounting equation is the fundamental equation that keeps together a balance sheet. Indeed, it states that assets always equal liability plus equity. The foundation of accounting is the double-entry system which assumes that a company balance sheet can be broken down in assets, and how they get sources (either though equity/capital or liability/debt).

Balance Sheet The accounting equation is the fundamental equation that keeps together a balance sheet. Indeed, it states that assets always equal liability plus equity. The foundation of accounting is the double-entry system which assumes that a company balance sheet can be broken down in assets, and how they get sources (either though equity/capital or liability/debt).

Balance Sheet

The purpose of the balance sheet is to report how the resources to run the operations of the business were acquired. The Balance Sheet helps to assess the financial risk of a business and the simplest way to describe it is given by the accounting equation (assets = liability + equity).

Income Statement The purpose of the balance sheet is to report how the resources to run the operations of the business were acquired. The Balance Sheet helps to assess the financial risk of a business and the simplest way to describe it is given by the accounting equation (assets = liability + equity).

Income Statement

The income statement, together with the balance sheet and the cash flow statement is among the key financial statements to understand how companies perform at fundamental level. The income statement shows the revenues and costs for a period and whether the company runs at profit or loss (also called P&L statement).

Cash Flow Statement The income statement, together with the balance sheet and the cash flow statement is among the key financial statements to understand how companies perform at fundamental level. The income statement shows the revenues and costs for a period and whether the company runs at profit or loss (also called P&L statement).

Cash Flow Statement

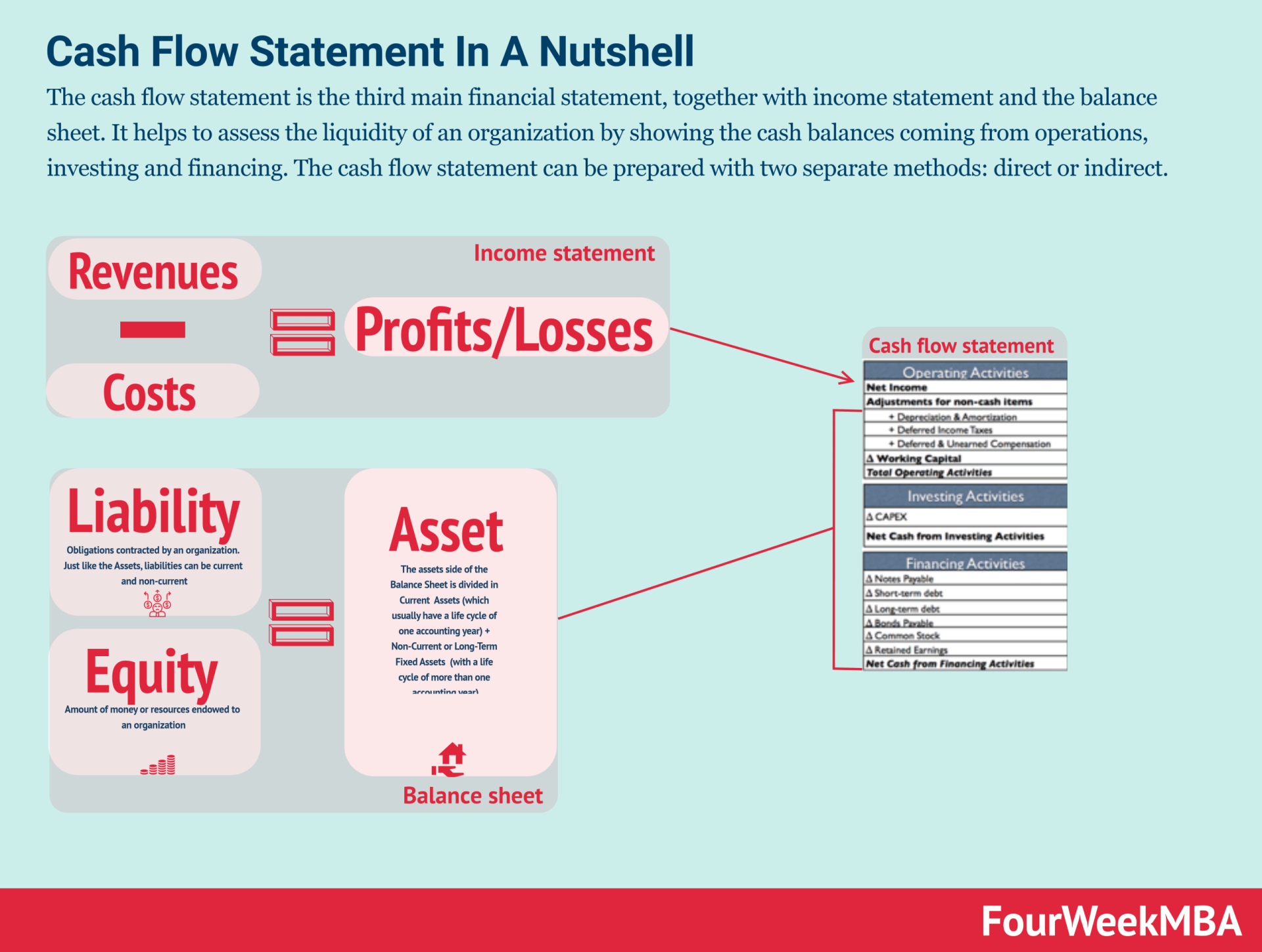

The cash flow statement is the third main financial statement, together with income statement and the balance sheet. It helps to assess the liquidity of an organization by showing the cash balances coming from operations, investing and financing. The cash flow statement can be prepared with two separate methods: direct or indirect.

Capital Structure The cash flow statement is the third main financial statement, together with income statement and the balance sheet. It helps to assess the liquidity of an organization by showing the cash balances coming from operations, investing and financing. The cash flow statement can be prepared with two separate methods: direct or indirect.

Capital Structure

The capital structure shows how an organization financed its operations. Following the balance sheet structure, usually, assets of an organization can be built either by using equity or liability. Equity usually comprises endowment from shareholders and profit reserves. Where instead, liabilities can comprise either current (short-term debt) or non-current (long-term obligations).

Capital Expenditure The capital structure shows how an organization financed its operations. Following the balance sheet structure, usually, assets of an organization can be built either by using equity or liability. Equity usually comprises endowment from shareholders and profit reserves. Where instead, liabilities can comprise either current (short-term debt) or non-current (long-term obligations).

Capital Expenditure

Capital expenditure or capital expense represents the money spent toward things that can be classified as fixed asset, with a longer term value. As such they will be recorded under non-current assets, on the balance sheet, and they will be amortized over the years. The reduced value on the balance sheet is expensed through the profit and loss.

Financial Statements Capital expenditure or capital expense represents the money spent toward things that can be classified as fixed asset, with a longer term value. As such they will be recorded under non-current assets, on the balance sheet, and they will be amortized over the years. The reduced value on the balance sheet is expensed through the profit and loss.

Financial Statements

Financial statements help companies assess several aspects of the business, from profitability (income statement) to how assets are sourced (balance sheet), and cash inflows and outflows (cash flow statement). Financial statements are also mandatory to companies for tax purposes. They are also used by managers to assess the performance of the business. Financial statements help companies assess several aspects of the business, from profitability (income statement) to how assets are sourced (balance sheet), and cash inflows and outflows (cash flow statement). Financial statements are also mandatory to companies for tax purposes. They are also used by managers to assess the performance of the business.

Read Next: What Is a Financial Ratio? The Complete Beginner’s Guide to Financial RatiosWhat Is a Financial Option? The Complete Beginner’s Guide to Financial Options Other business resources: Successful Types of Business Models You Need to Know The Complete Guide To Business Development Business Strategy: Definition, Examples, And Case Studies What Is a Business Model Canvas? Business Model Canvas Explained Blitzscaling Business Model Innovation Canvas In A Nutshell What Is a Value Proposition? Value Proposition Canvas Explained What Is a Lean Startup Canvas? Lean Startup Canvas Explained What Is Market Segmentation? the Ultimate Guide to Market Segmentation Marketing Strategy: Definition, Types, And Examples Marketing vs. Sales: How to Use Sales Processes to Grow Your Business How To Write A Mission Statement What is Growth Hacking? Growth Hacking Canvas: A Glance At The Tools To Generate Growth Ideas Related |

【本文地址】